There is increased talk in the blockchain industry about #DeFi or “decentralized finance”, which is enabled by systems such as Bitcoin and Ethereum Classic. However, much of that talk refers to performance, e.g. achieving similar transaction capacity as traditional centralized systems, lowering barriers for new entrants, doing regulatory arbitrage, or using tokens to “incentivize” particular behaviors in users.

Although many of those goals are certainly possible using blockchains, the conversation has geared away from the true parading shift that blockchain brings: Trust minimization.

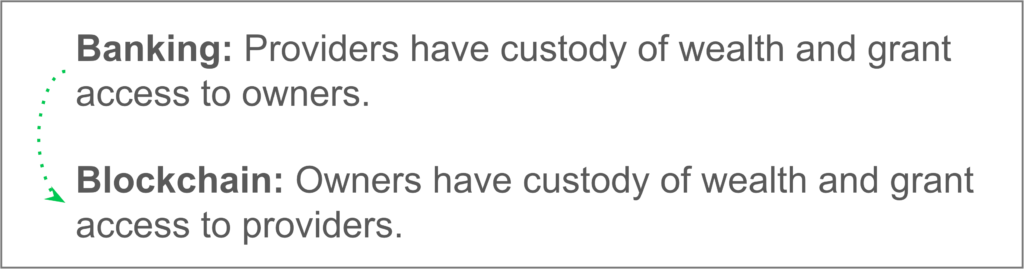

In the traditional banking industry, customers don’t really have control of their financial assets, they really have IOUs from financial providers. Trust minimization in the financial industry means this level of trust in providers is not necessary and the transfer in custody to the customer gives users several benefits that were not possible before Bitcoin and Ethereum Classic.

The Old Paradigm

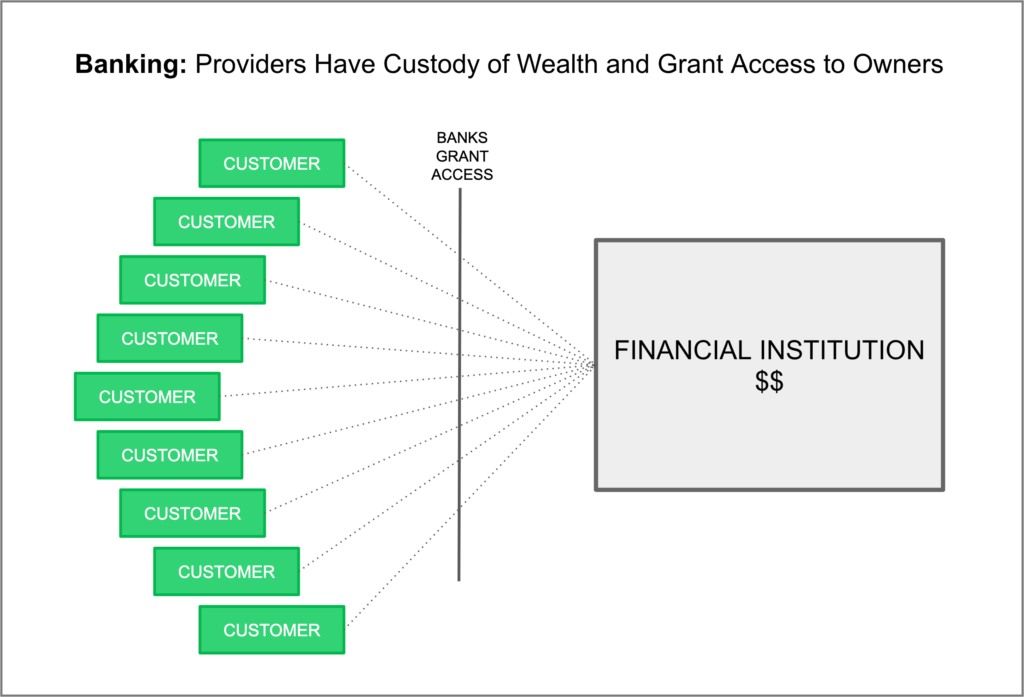

The way banking has evolved in the last 600 years is that customers have eventually deposited all their assets into financial institutions, and providers grant special and restricted access to their wealth.

This gives providers all the control over people’s wealth which puts it at risk in many ways. For example, banking actually creates money by lending customer’s fund several times over, this is called fractional reserve banking, which is a significant credit risk.

When it comes to securities, a large portion of people’s wealth is in “street name“, something customers sign in the client margin account agreements, sometimes without even being aware of it, so brokerage firms can use those securities for lending to short sellers. This practice also creates a sort of “securities fractional reserve system” as more people have the illusion of owning the same securities. This was shown in the Dole Food Co. ordeal.

Another detrimental effect of this amount of trust and delegation to financial institutions is something called “vendor lock-in” which is the phenomenon that, for users, it is extremely costly to move from one provider to another, sometimes due to regulation or just sheer time and paper work, so bankers use this to extract as much revenue as possible from their trapped clients’ wealth. Much of which is in hidden or difficult to avoid fees.

The most important underlying pattern is that lack of trust minimization in banking means financial providers hold people’s money and wealth, people’s personal data, they manage everything on centralized servers, they can be hacked, and can behave badly, as seen in the last financial crisis of 2007/8.

The New Paradigm Shift

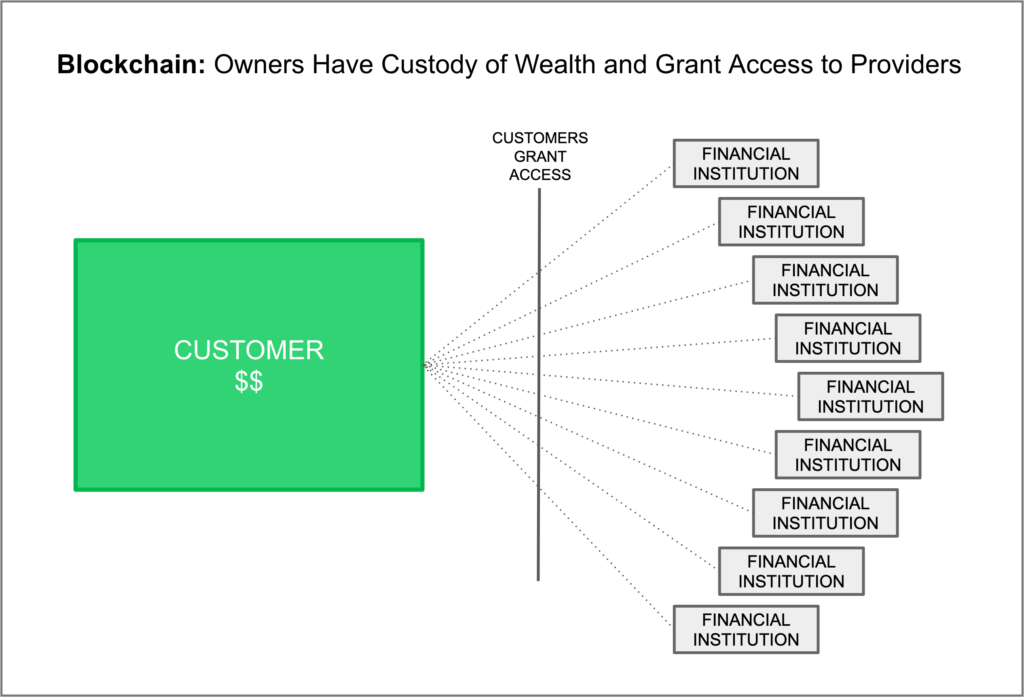

The new way banking will evolve to is that customers will regain custody and control of their wealth, so they will grant restricted access to financial providers. This is accomplished in blockchains such as Bitcoin and Ethereum Classic because user assets are stored in their own accounts or smart contracts, which they solely control with their private keys.

“Restricted access” to financial institutions means that customers will now have the ability to select what products and services to use from providers, will be able to easily change providers, providers will have to adjust their fees and rates to compete, and users will actually have a larger portfolio of products and providers to choose from on a global scale. In other words “vendor lock-in” is greatly minimized, or outright eliminated.

The above additionally gives owners of wealth the option whether their assets, or what portion of them, are used in fractional reserve systems depending on the service, return, and security guarantees providers may offer. This greatly minimizes credit risk and gives users a power they didn’t have before.

The most important underlying pattern that changes in the new paradigm is that owners hold their money and wealth, their personal data, and manage everything on decentralized networks. In other words, they gain maximized control of their assets.

Implications for Decentralized Finance

There are too many dapps that basically mimmic traditional systems, so aggregate the wealth of their users in insecure re-centralized settings. The most paradigmatic example was The DAO in 2016. It was a single smart contract that held all the money from their users, and they had to vote for every move The DAO made, making it a collective “democratic” centralized system, again, rather than users controlling their own individual wealth. The point that showed the systemic risk of such setup was that one bug in the code practically destroyed the whole structure. Then, the ecosystem of the underlying network further showed its structural risks by deciding to collectively bailout the users from the losses, because it was “too big to fail”, violating all the rules in the book about secure blockchains and trustworthy computing.

What all #DeFi projects have to follow is the design described above. All users funds must stay in control of their owners as much as possible. Sending money to centralized smart contracts, even in exchange for tokens, has to be minimized. Decentralized finance dapp developers have to minimize their own control on aggregate amounts of money, but provide services on an account per account, or smart contract per smart contract basis.

As an example, this was the original design of the Etherplan wealth management system, where each customer had control over their assets in their “smart investment plans” or “SIPs”, but granted restricted access to specific money managers to invest their money, but with no ability to move funds from the accounts. The same model was the base structure of the Etherplan retirement plans for small businesses.

Conclusion

The traditional banking system controls people’s assets, and now that practically all financial assets are digitized, this puts them at great trusted third party risk, who can be irresponsible, get hacked, or even plain fraudulent.

The new paradigm is very simple, just move wealth into owners hands again. Any #DeFi project can call itself such only if they do this, if not they are just re-centralizing their services again, and people must be cautious of this.

by: Donald McIntyre

Code is Law

Comments